Homeowners Insurance in and around Phoenix

Phoenix, make sure your house has a strong foundation with coverage from State Farm.

Give your home an extra layer of protection with State Farm home insurance.

Would you like to create a personalized homeowners quote?

- Superior

- Phoenix

- Tempe

- Arizona

- Ahwatukee

- Sun City

- Laveen

- Maricopa County!

- Mesa

Welcome Home, With State Farm Insurance

Homeownership is a lot of responsibility. You want to make sure your home and the possessions in it are protected in the event of some unexpected accident or catastrophe. And you also want to be sure you have liability insurance in case someone stumbles and falls on your property.

Phoenix, make sure your house has a strong foundation with coverage from State Farm.

Give your home an extra layer of protection with State Farm home insurance.

Safeguard Your Greatest Asset

State Farm Agent Andy Carrillo is ready to help you handle the unexpected with dependable coverage for your home insurance needs. Such personalized service is what sets State Farm apart from the rest. And it won’t stop once your policy is signed. If mishaps occur, Andy Carrillo can help you submit your claim. Find your home sweet home with State Farm!

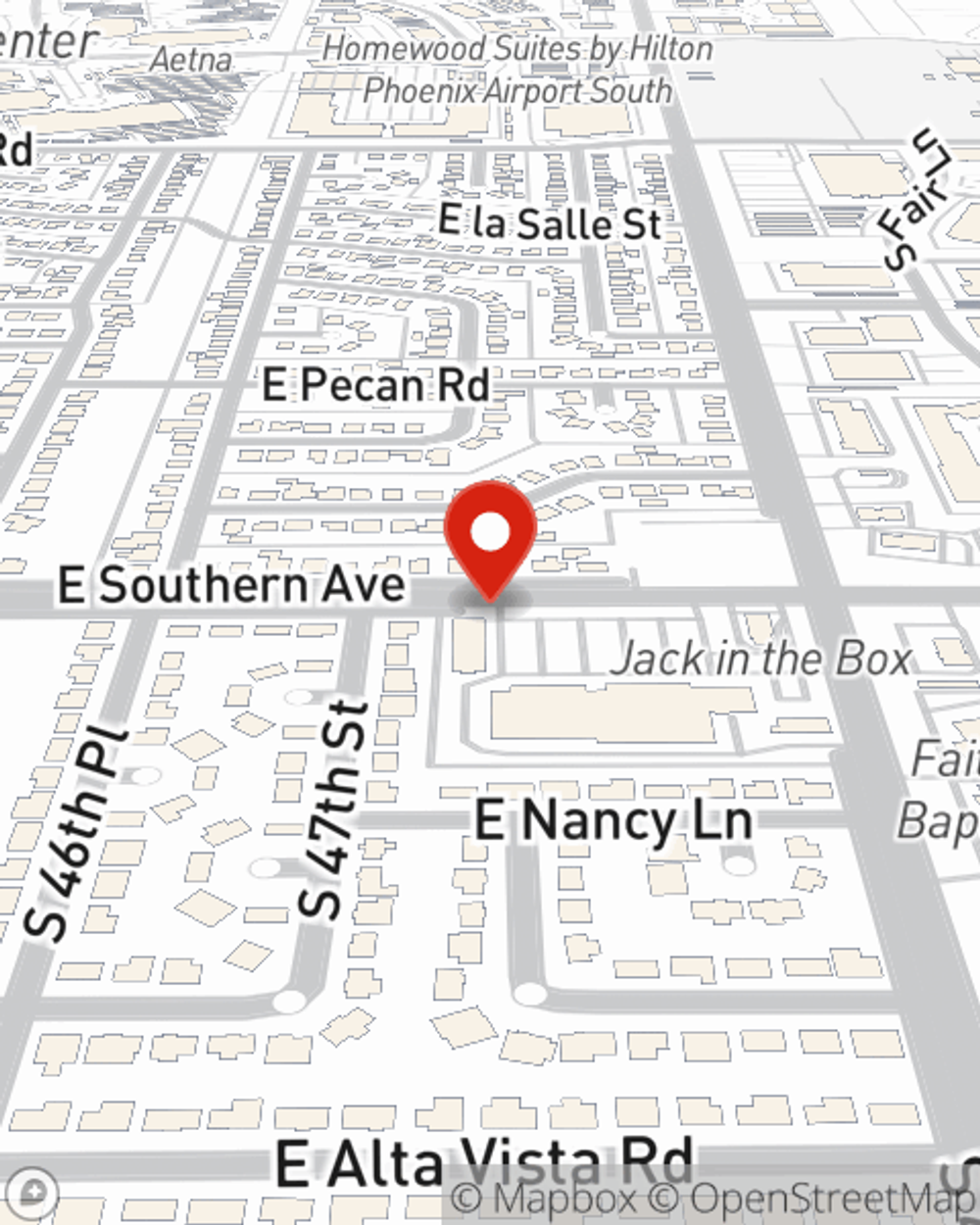

Phoenix, AZ, it's time to open the door to secure insurance. State Farm agent Andy Carrillo is here to assist you in understanding the policy that's right for you. Visit today!

Have More Questions About Homeowners Insurance?

Call Andy at (602) 426-8088 or visit our FAQ page.

Protect your place from electrical fires

State Farm and Ting* can help you prevent electrical fires before they happen - for free.

Ting program only available to eligible State Farm Non-Tenant Homeowner policyholders

Explore Ting*The State Farm Ting program is currently unavailable in AK, DE, NC, SD and WY

Simple Insights®

How to clean gutters and downspouts safely

How to clean gutters and downspouts safely

Regular gutter cleaning may help you avoid expensive repairs to your home and yard. Learn how to clean gutters safely.

Andy Carrillo

State Farm® Insurance AgentSimple Insights®

How to clean gutters and downspouts safely

How to clean gutters and downspouts safely

Regular gutter cleaning may help you avoid expensive repairs to your home and yard. Learn how to clean gutters safely.